Ongoing Planning & Pricing:

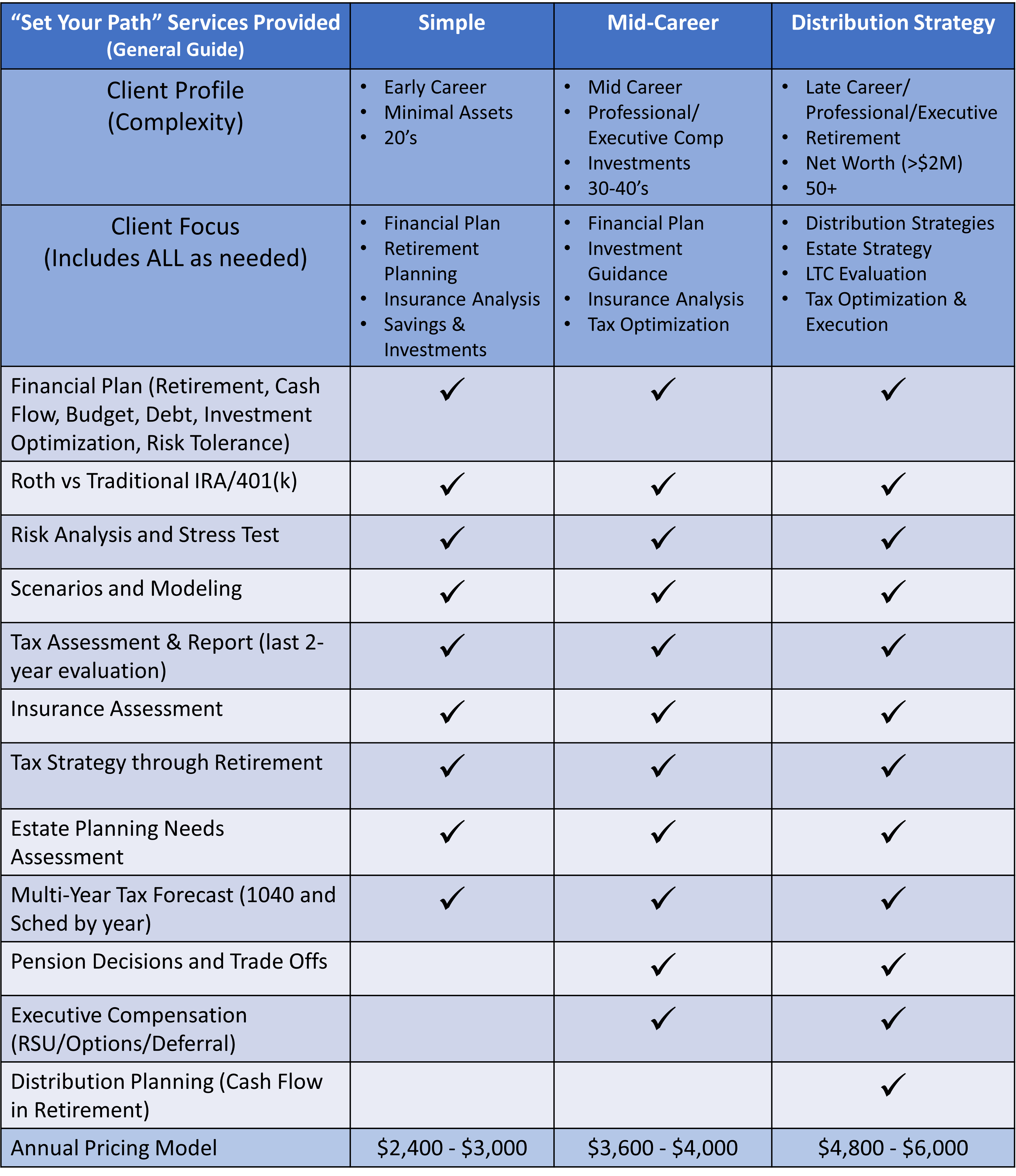

Services include an annual comprehensive plan plus periodic meetings throughout the year. Each meeting will adjust for actual versus what was forecast. For example, tax planning happens in Q1 and Q4. Budget discussions in Q1.

Ongoing Planning services will depend on where you are in your life stage and the complexity of the planning required. There is an upfront onboarding fee for new clients, up to $1,500 depending on complexity.

We also do One-Time plans and Projects. This can be a comprehensive financial plan or focused on a specific area. Often, answering a simple question the right way can entail more than just that one aspect. "Should I do a Roth" may still require a fairly comprehensive review since it's mostly about long-term tax planning.

Investment Management

This feature only comes with ongoing planning - it's important to understand your objectives to ensure the allocation of assets are appropriate to meet your needs. There are no minimums for Assets Under Management (AUM). We also believe the typical 1% model is outdated and there is automation/productivity with scale that does not justify those fees for higher levels of investment management. Our AUM pricing model scales quickly for your earning effectiveness. We discount ongoing planning subscriptions for larger AUMs.

| Assets Under Management | Annual Fee |

|---|---|

| $0 - 500,000 | 0.50% |

| $500,000 - $1,000,000 | 0.35% |

| $1,000,001 - $1,500,000 | 0.30% |

| $1,500,001 & Above | 0.25% |